The market for electric medium- and heavy-duty trucks continues to grow as technology advances and customer adoption increases. This is helping drive sales for the electric powertrain components used in these vehicles – such as batteries and electric motors.

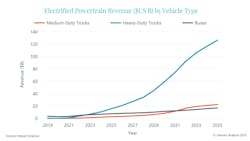

Interact Analysis’ latest commercial vehicle report shows global revenue for electrified powertrain components used in medium- and heavy-duty trucks exceeded that of buses for the first time in 2023. Revenue for components used in electric trucks reached $8.6 billion while that for buses came in at $6.1 billion.

Electric buses have dominated the market for the last several years due to this portion of the transportation sector being an early adopter of electrification solutions. Frequent stops throughout the day and the vehicles returning to a home base for overnight charging made buses a good fit for electrification.

A high percentage of electric buses have been sold in recent years as cities look to reduce emissions to improve health and safety as well as environmental impacts.

However, the market uptake of electric trucks has grown in recent years. Interact Analysis said in its report electric medium- and heavy-duty trucks still make up a small percentage of the global market (2.6% as of 2023) but a higher volume of them is sold than buses which has helped increase revenue for their electrified powertrain components.

Battery-Electric Trucks Will Drive Market Value

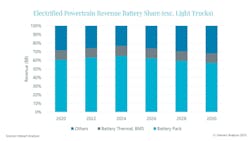

Per Interact Analysis, much of the revenue potential for the electric powertrain components market will come from battery-electric vehicles as they are the dominant type in the market. Battery technology has matured to a point where it is able to meet the needs of the trucking industry, although further improvements continue to be made.

The research firm also noted battery-electric has won out over hybrid and hydrogen options, at least for the moment, because of the lower costs associated with the technology and the good per mile running cost offered by these vehicles.

For the trucking industry at least, hybrid has not proven to be as beneficial in terms of maintenance improvements and there is little legislative backing for the technology. Larger off-highway machines, such as construction equipment, are where hybrid likely has more potential as their requirements for full electric operation are much more challenging than that of heavy trucks.

Many companies are still pursuing hydrogen as an option as it has the potential to suit certain niche applications and could be the better option for longer haul applications. But refueling infrastructure remains a large hurdle to overcome as well as economical hydrogen production.

With many truck OEMs focusing their development efforts on battery-electric vehicles, battery packs are forecast to be the largest revenue driver for the electrified powertrain components market. When including battery management systems and thermal management systems, they will account for over 70% of the total market in the coming years.

Inverters, onboard chargers and power distribution units (PDU) are also expected to contribute significant revenue for the market as there are fewer companies developing these components and higher profit margins associated with them.

Development of Electric Trucks on an Upward Trend

The electric powertrain components market is benefiting from the trucking industry’s push toward electrification. While there are still many issues that need to be addressed – such as charging infrastructure, range and battery weight – this sector is increasing its use of electric powertrains to help reduce emissions as well as offer cost and maintenance benefits to vehicle owners.

Implementation of emissions regulations in various parts of the world is a key motivator for the industry increasing its use of electrified solutions but there are also many manufacturers who see it as both a societal need and business opportunity.

Interact Analysis said most activity in the electric vehicle sector has been focused on passenger cars, buses and smaller trucks, such as pickups, but there is clearly a shift taking place in the market as more medium- and heavy-duty trucks become electrified.

It foresees larger electric trucks becoming a bigger opportunity in the coming years as development efforts increase further. In addition to the business opportunities it will present to component manufacturers and others serving the market, electrifying trucks will contribute to global decarbonization efforts.

Per the research firm, a mile in an electric truck eliminates more carbon dioxide (CO2) than a mile in an electric car. Additionally, the annual mileage of trucks – especially larger trucks – is typically higher which means more CO2 savings when replacing a fossil fuel vehicle with an electric vehicle.

Besides emissions reductions, electric vehicles offer the possibility of lower maintenance costs. Electric components do not require as much maintenance as their mechanical counterparts because there are fewer wear points. Rising fuel costs have made electric vehicles more attractive as well because it generally costs less per mile to power a truck with electricity than diesel.

These benefits are often larger drivers for customer adoption as they have a direct impact on operational costs. Medium- and heavy-duty trucks are typically used for business purposes and therefore need to meet a fleet’s functional and economical requirements.

READ MORE - The Real Driver of Electrification: Fighting Climate Change or Commercial Gains?

Heavy-Duty Trucks will Drive Long-Term Growth

According to Interact Analysis’ research, heavy-duty trucks (typically Class 7 and 8) will account for the largest portion of revenue potential, especially in the longer term. This is due to the high volume of components required by these large vehicles which equates to higher revenue per vehicle. The market intelligence firm estimates the average powertrain value for a heavy-duty truck in the Americas is $229,863 per vehicle.

There are of course challenges associated with electrifying heavy-duty trucks, such as charging infrastructure requirements and the amount of battery power required. However, this has not prevented OEMs and component manufacturers from developing electrified solutions.

The VNR Electric from Volvo Trucks Noth America is one such example already out in the market. It is an all-electric Class 8 truck with a range of up to 275 mi., making it well suited for local and regional operations.

Electric trucks for long-haul operations remain the bigger challenge because of their range and battery power requirements. But development efforts are ongoing to overcome these due to the many benefits associated with going electric.

READ MORE - Danfoss Puts Volvo Electric Trucks into 24-Hour Service

Medium-Duty Trucks Also Offer Potential

Electrification of medium-duty trucks is increasing as well, which will benefit the electrified powertrain component market. This was evident during Work Truck Week 2024 – an annual event focused on the work truck industry which includes many medium-duty trucks – where several OEMs showcased new electric vehicles. Component suppliers were present as well showcasing their various technologies for electric trucks.

ePTOs (electric power take-offs) were on display at many booths with some exhibitors telling Power & Motion demand from OEMs is increasing for this component. PTOs are commonly used to transmit power from an engine or transmission to hydraulic systems. As hydraulics will still be an important part of many work trucks, even as electrification increases, it will be necessary to develop PTOs capable of transmitting power from the batteries which are used in place of engines.

Mack Trucks displayed its MD Electric, an electrified version of its medium-duty truck, which was introduced during Work Truck Week 2023. Production for the truck began in late 2023 and the company has already started making deliveries to customers.

Various electric powertrain components featured on the MD Electric include an air-cooled lithium-ion battery using a Nickel Manganese Cobalt (NMC) chemistry, a three-phase permanent magnet synchronous motor providing 138 kW (185 hp) continuous power and a cooling system comprised of a radiator and two electric fans.

Like many OEMs, Mack Trucks aims to increase the number of electric-powered vehicles it has in the market over the coming years. In line with targets set by parent company Volvo Group, it has set the following goals:

- 35% electric vehicles by 2030

- 100% fossil-free vehicles by 2040

- 100% fossil-free rolling fleet by 2050.

It plans to offer a combination of vehicles powered by battery-electric and fuel-cell electric technologies as well as internal combustion engines fueled by biofuels and renewable diesel to meet these goals.

Jim Castelaz, founder and chief revenue/technology officer at Motiv Power Systems – a developer of medium-duty electric trucks and buses – told Power & Motion during an interview at Work Truck Week that interest from medium-duty truck fleets in electric options has been steadily building. It is at a point where most fleets have a plan for going electric. Their timelines vary, but it is the direction many are headed.