Continued technological advancements in hydraulics and pneumatics will be driven by a range of industry trends and customer requirements. To help guide future designs, the National Fluid Power Association (NFPA) has published its 2023 Technology Roadmap, a document outlining target areas in which the fluid power industry should consider focusing its development efforts.

“The technology roadmap is a document that describes the industry-wide consensus regarding the precompetitive research and development (R&D) needs associated with improving the design, manufacture and function of fluid power components and systems,” said Eric Lanke, President and CEO of NFPA, during a presentation announcing publication of the roadmap at the association’s 2023 Industry & Economic Outlook Conference (IEOC). “It's an R&D agenda of what we need to do to improve our fluid power products, so that they can play a larger role in the technology strategies of our many different customer groups.

“It's used widely across our supply chain by our academic partners to guide their research efforts, by our own members to make decisions about product development choices or partnerships that they want to enter into; increasingly, it's actually being used by academic, government and other organizations that are funding research and want to pursue projects that are of importance to our industry,” he said.

As described in the Technology Roadmap, it is comprised of five key elements:

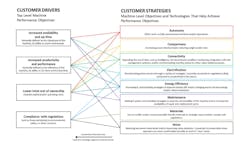

- Customer Drivers – the top‐level performance objectives of fluid power customers, the OEMs or machine builders that manufacture machines that often incorporate fluid power systems. Customer Drivers help these machine builders serve the needs of their own customers and are not necessarily connected to their use of fluid power.

- Customer Strategies – the machine–level objectives and technologies that the machine builders have set or are using to help them achieve the top‐level performance objectives described by the Customer Drivers. These Customer Strategies are not necessarily connected to their use of fluid power.

- Capability Improvements – the ways in which fluid power systems must improve if they are to participate or increase their participation in the technology trends described by the Customer Strategies.

- Research Areas – the broad areas of pre‐competitive investigation that could assist in bringing about the Capability Improvements.

- Research Targets – the objectives that quantify or otherwise describe successful strategies for pursuing the Research Areas.

What Customers Want from Fluid Power

To determine the areas in which fluid power manufacturers should focus their future design efforts, it is necessary to first understand what performance aspects are important to their customers. “You don’t innovate for the sake of innovation; you innovate to solve problems. Starting with the customer drivers and then working from there really gives a lot of credibility to the roadmap,” said Steve Meislahn, Managing Director, Sun Hydraulics and vice chair of the NFPA Roadmap Committee, during the presentation on publishing of the roadmap document at the 2023 IEOC.

NFPA surveyed members and others across the fluid power supply chain to help determine key technology needs for the top 20 largest customer markets. Construction and agricultural machinery, material handling, automotive and trucking, various manufacturing segments and more are among the top fluid power customer markets noted by NFPA in the technology roadmap.

“These are the 20 markets that we really paid most attention to as we went through the strategy…so, when we talk about customers and their needs, its customers that fit into one of these 20 major markets,” said Lanke.

In determining key fluid power customer needs for the 2023 roadmap, NFPA first asked survey respondents to assess those laid out in the 2021 edition – such as increased availability and uptime, increased performance and on-time delivery – as well as what new drivers may have emerged since the publishing of that document. For the latter, autonomous operation, machine communication and ease of serviceability were among the top responses.

The NFPA Roadmap Committee used these survey responses to narrow down the performance aspects customers desire from fluid power components. It decided the best way to do so was distinguishing between Customer Drivers and Customer Strategies. “The drivers are what they want to achieve, and the strategies are how they’re going about achieving those drivers,” explained Lanke.

The top four Customer Drivers outlined in the 2023 roadmap are:

- Increased availability and uptime

- Increased productivity and performance

- Lower total cost of ownership

- Compliance with regulations.

Based on those drivers, the following eight Customer Strategies were determined:

- Autonomy – Either semi- or fully-autonomous functions and/or operations.

- Compactness – Increasing power density and/or reducing weight and/or size.

- Connectivity – Expanding the use of data, such as intelligence for cloud-based condition monitoring, integration with site management systems, and/or communicating machine status for other value-added purposes.

- Electrification – Decarbonizing prime movers through a variety of strategies. Currently connected to regulations; likely connected to productivity in the future.

- Energy Efficiency – Increasing it; and including strategies to improve battery life and/or charging and to use less energy and/or reduce emissions.

- Maintenance – Making it easier; and including strategies to ease the serviceability of the machine and to increase the availability of repair and replacement parts.

- Materials – Use of conflict and/or environmentally friendly materials in strategic ways to better comply with regulations.

- Noise – Reducing perceived noise levels and/or improving noise pulsation. Connected to productivity when operators are more comfortable and able to work in “new” areas.

READ MORE: NFPA Sets Customer Drivers and Strategies for 2023 Technology Roadmap

Meislahn said that connectivity and electrification, and the addition of sensors to get data are the top requests his company is hearing from customers. Autonomy is the objective many are trying to achieve, and connectivity and electrification are among the foundational steps for achieving that goal, he said.

From a pneumatics perspective, Scott Meldeau, Vice President, Norgren – a company which also took part in the Roadmap Committee – said during the IEOC presentation that connectivity and electrification were also growing areas of interest. There are also some upcoming regulations which could have a direct impact on pneumatics manufacturers and their customers.

How Well is Fluid Power Meeting Customer Needs?

While reviewing survey responses for the key customer drivers, the Roadmap Committee found there was not much variation between those of most importance to the top hydraulics and pneumatics customer markets. The most important drivers – “Increased availability and uptime” and “Increased productivity and performance” – were noted as such by both customer segments, demonstrating the broad appeal of these performance targets.

However, the customer driver “Increased energy efficiency” ranked slightly higher for hydraulic customer markets and for pneumatics customers it was “Easier and more predictable maintenance,” indicating potential areas in which fluid power manufacturers should focus future developments.

After determining the key customer performance requirements, NFPA next surveyed the fluid power supply chain to determine the industry’s ability to meet them as outlined by the Customer Strategies. Individual surveys were sent related to hydraulics and pneumatics to best assess how each technology is meeting OEM and machine builders’ needs.

From the responses, it was determined the hydraulics sector does well at meeting customers’ Compactness and Materials requirements, but the largest improvements could yet be made in the areas of Connectivity and Electrification.

Maintenance was the Customer Strategy for which pneumatics currently appears to be well aligned based on the survey results. Electrification and Compactness were the top areas of potential improvement.

Based on these surveys and customer performance objectives, the Roadmap Committee next outlined the Capability Improvements that would be needed for fluid power systems to meet the Customer Strategies. Survey participants were asked to assess the Capability Improvements laid out in the 2021 edition of the roadmap as well as offer new suggestions.

From the responses to each of those questions, the committee determined the eight Capability Improvements which could be made to fluid power systems:

- Data – Improving the ability to monitor, gather and use data generated from fluid power products and/or systems.

- Ease of Use – Improving ease of use and application of fluid power (through automated control, communications, increased dynamic performance, etc.).

- Energy Efficiency – Increasing the energy efficiency of fluid power products and/or systems.

- Environmental Impact – Reducing the environmental impact of fluid power products and/or systems (i.e., leaks, sustainable materials, damage to environment).

- Noise – Reducing the level and harshness of the noise generated by fluid power products and/or systems.

- Power Density – Increasing the power density of fluid power products and/or systems.

- Reliability and Durability – Improving the reliability and/or durability of fluid power products and/or systems.

- Safety – Improving the safe use and application of fluid power products and/or systems.

Lanke said this is the first time he can recall the need to increase safety making it into the roadmap, demonstrating the growing importance of “[ensuring] fluid power systems are safe and easy to use within the different customer strategies.”

He went on to say that these Capability Improvements can provide a helpful guide for fluid power companies who want to help customers with the strategies they are pursuing as well as determine ways to develop or improve hydraulic and pneumatic products.

From Meislahn’s perspective, ease of use is likely the most critical Capability Improvement for the industry. He said there are a lot of connectivity and data technologies out there, like CANbus, for which more fundamental knowledge is needed to aid with ease of use. “A lot of these technologies exist but they’re not really intuitive or easy to put together,” he said. As such, he sees it as an area of improvement which could help the fluid power industry keep up with competing technologies.

Meldeau sees data as a key area of focus, especially in terms of making sense of the data which is collected and interpreting it in a valuable way. The connectivity side is also of importance for helping to understand how a whole system is behaving.

READ MORE: The Continued Evolution of Hydraulics and Pneumatics

Future Hydraulic and Pneumatic Design Initiatives

To help fluid power manufacturers develop their products in a way that will meet the Capability Improvements, the roadmap includes research areas and targets for each which could help manufacturers achieve those improvements.

Similar to the other elements of the Technology Roadmap, members of the fluid power supply chain were asked what Research Areas outlined in the 2021 roadmap could aid with the 2023 Capability Improvements and what new areas of research may be needed. Based on survey responses, the following Research Areas were determined for the 2023 Technology Roadmap:

- Components – Develop new fluid power components.

- Control – Improve the controllability of fluid power systems.

- Data Analytics – Improve use of data analytics in fluid power systems.

- Fluids – Optimize the use of fluids and lubrication in fluid power systems.

- Manufacturing – Develop/apply new manufacturing technologies for fluid power components and systems.

- Materials – Develop/apply new materials in fluid power components and systems.

- Seals – Optimize the use of seal technologies in fluid power systems.

- Sensors – Advance sensor technologies used in fluid power systems.

- System Architecture – Explore novel fluid power system architectures.

From here, a list of Research Targets – objectives that will aid pursuit of the Research Areas – were outlined by the Roadmap Committee for each of the Capability Improvements. To do so, the committee created working groups for each Capability Improvement which created a prioritized list of Research Areas and Targets for their assigned improvement.

As an example, for the Capability Improvement of Data it was determined by the committee Data Analytics and Sensors were the top Research Areas on which to focus. From there, the top Research Targets for each are outlined in the roadmap:

Data Analytics

- Improve data processing capabilities through the use of edge computing (on‐board sensing and processing) and/or through the use of cloud computing.

- Data Analysis: Improve data analysis capabilities through the use of artificial intelligence and/or machine learning.

- Data Utilization: Apply improved data gathering, processing, and analysis capabilities to specific machine or system outcomes, including increased efficiency, automated functions and/or operation, and end‐of‐life prognostics and preventative maintenance.

Sensors

- Wireless Sensors: Improve the capabilities, reliability, and availability of wireless sensors for use in fluid power systems. Pursue strategies to improve their connectivity to data‐generating devices, to embed them in components and systems and lowering their maintenance requirements (no need to replace batteries or recalibrate, self-diagnosing, failure‐proof), and to lower their cost without reducing their effectiveness.

- Sensor Materials: Develop and apply sensor materials that are non‐aluminum and non‐sparking.

Download the full 2023 NFPA Technology Roadmap from the NFPA’s website to see the full list of Research Areas and Targets for each Capability Improvement.

Lanke said the Roadmap Committee was then tasked with prioritizing the Research Targets to those which would “likely have the largest opportunity to move the needle in making progress on fluid power capability development and system applications for some of the Customer Strategies.”

The committee narrowed the list down to 12 Research Targets which coincide with each of the Research Areas:

- Prediction Tools – Analyze impact of operational realities on components and develop modeling and prediction tools for their lifecycle and potential failure.

- Power Density – Develop more power dense components; ensure their safe use and application.

- On-Demand Power – Improve and develop on-demand power capabilities.

- Data Utilization – Apply improved data gathering, processing and analysis capabilities to specific machine or system outcomes.

- Environmentally Friendly – Develop longer-lasting, biodegradable, environmentally-friendly fluids that reduce leakage and improve efficiency.

- Additive – Develop cost-competitive additive materials, develop improved design tools for, and apply additive manufacturing to produce high-pressure capable components.

- Coatings – Develop coatings that reduce friction and heat.

- Higher Pressure – Test and record the max pressure ratings for different materials used in components; improve ability of components to handle higher pressures.

- Seal Materials – Develop new and sustainable seal and wear-ring technologies that can resist wear, reduce friction and eliminate external leakage.

- Prediction Tools – Improve ability to measure and predict seal wear and life.

- Wireless Sensors – Improve the capabilities, reliability and availability of wireless sensors for use in fluid power systems.

- Distributed Systems – Develop more efficient, distributed system architectures.

Of the Research Areas and Targets, Meislahn said data analytics is the one which jumps out to him as a high priority because of all the sensor integration and data collection taking place. Determining how to use the data and provide value to customers will be key as well. He also noted the importance of control and power-on-demand capabilities as battery-electric vehicles become more commonplace in various industries.

Meldeau agreed that data analytics and making sense of the data collected are key areas on which the industry should focus research efforts. He noted additive manufacturing is an area of interest as well, looking at use of different metals and the other potential opportunities.

READ MORE: Additive Manufacturing Brings Opportunities to Improve Component Design and Production

Overall, the Technology Roadmap outlines a wide range of areas in which the fluid power industry can focus its future developments. But as Lanke said, it also demonstrates the fact there is a lot of opportunity for the industry as well as discussions and partnerships between the many companies in the broader hydraulics and pneumatics supply chain.